General information

Software Introduction

VIEWS

VIEW BREAKDOWN

- Portfolio Rolling 12 Month Returns

- Portfolio Rolling 24 Month Returns

- Long Positions Breakdown Chart

- Active Symbols

- Current / Projected Positions

- Open Positions

- Portfolio List

- Monthly / Annual Returns

- Portfolio Orders

- Portfolio Symbol Returns

- Portfolio Trade Log

- Portfolio Trade Profile

- Combined Symbol Stats

- Fundamental Snapshot

- Quick Search

- Research

- Symbol History

- Symbol Model Results

- Symbol Stats History

- Symbol Trade Log

- Symbol Trade Profile

- Trend / Resistance / Support

- Queries

- Reports

- Watch List Triggers

- Watch Lists

PERSPECTIVES

PORTFOLIO

QUERY

WATCH LIST

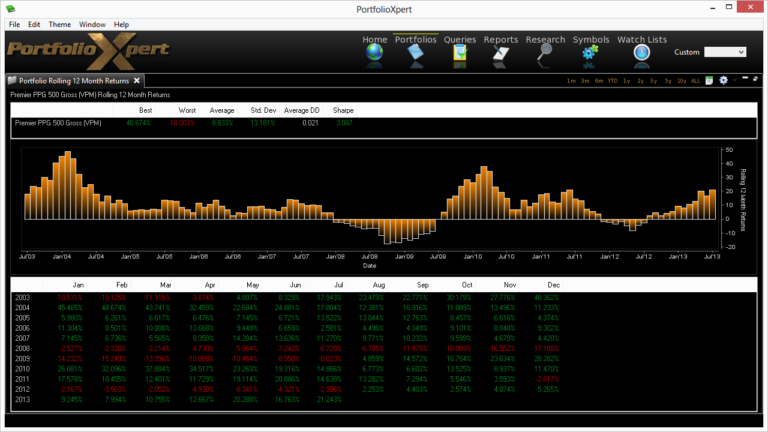

Portfolio Rolling 12 Month Returns

The Portfolio Rolling 12 Month Returns view displays the rolling 12-month returns for previous calendar years and the current calendar year for a selected portfolio.

View Tab

- Double click the view tab to maximize the view full screen. Double click it again to restore.

- Right mouse click on the view tab to open the view popup menu.

- Click

- in the view tab to close the Portfolio Rolling 12 Month Returns view.

- Left mouse click the view tab and hold down the mouse button to move the Portfolio Rolling 12 Month Returns view. Release the mouse button to place it.

View Toolbar

The View Toolbar contains controls and settings specific to the Portfolio Rolling 12 Month Returns view.

Time Interval buttons

- Click a time interval button

- to select the time frame displayed in the bar graph and table.

Table to Spreadsheet button

- Click

- to export the table to a spreadsheet (sorting applied prior to exporting will be preserved in the spreadsheet).

General Settings button

- Click

- to select the time frame displayed in the table (contains additional time frames not present as time interval buttons, such as 9 Months and Custom) and to select whether or not to have Domain Lines Visible and/or Range Lines Visible (screenshot).

Copy, Save, or Print

Right mouse click on the bar graph to open a popup menu with the options to Copy, Save, or Print (screenshot).

Information Displayed

- Best – best rolling period return for the portfolio during the period displayed in the table

- Worst – worst rolling period return for the portfolio during the period displayed in the table

- Average – average rolling period return for the portfolio during the period displayed in the table

- Std. Dev – standard deviation of the rolling period returns for the portfolio during the period displayed in the table (this standard deviation calculation is not a holding period standard deviation but rather a standard deviation of the values presented in the table)

- Average DD – average decline from each peak to each trough over the portfolio’s entire history

- Sharpe – measure of the portfolio’s back-tested risk-adjusted returns per unit of total risk or annualized volatility as measured by the standard deviation over the portfolio’s entire history (higher ratio suggests a better risk-adjusted performance)