DYNAMIC MARKETS

ADAPTIV

Many advisory firms have been subject to large swings of equity in their firms causing negative implications for their clients and for their firms.

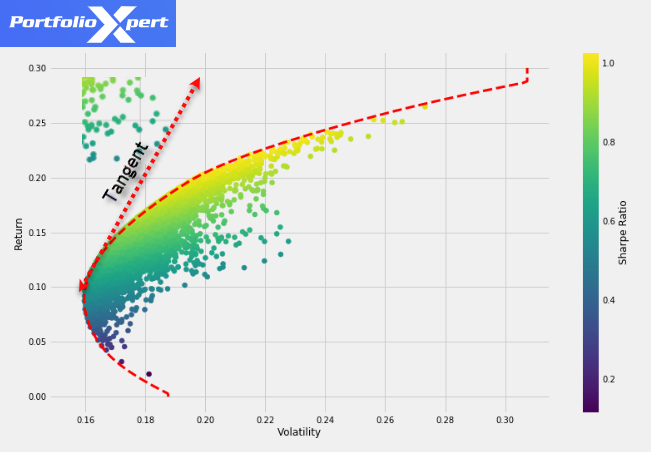

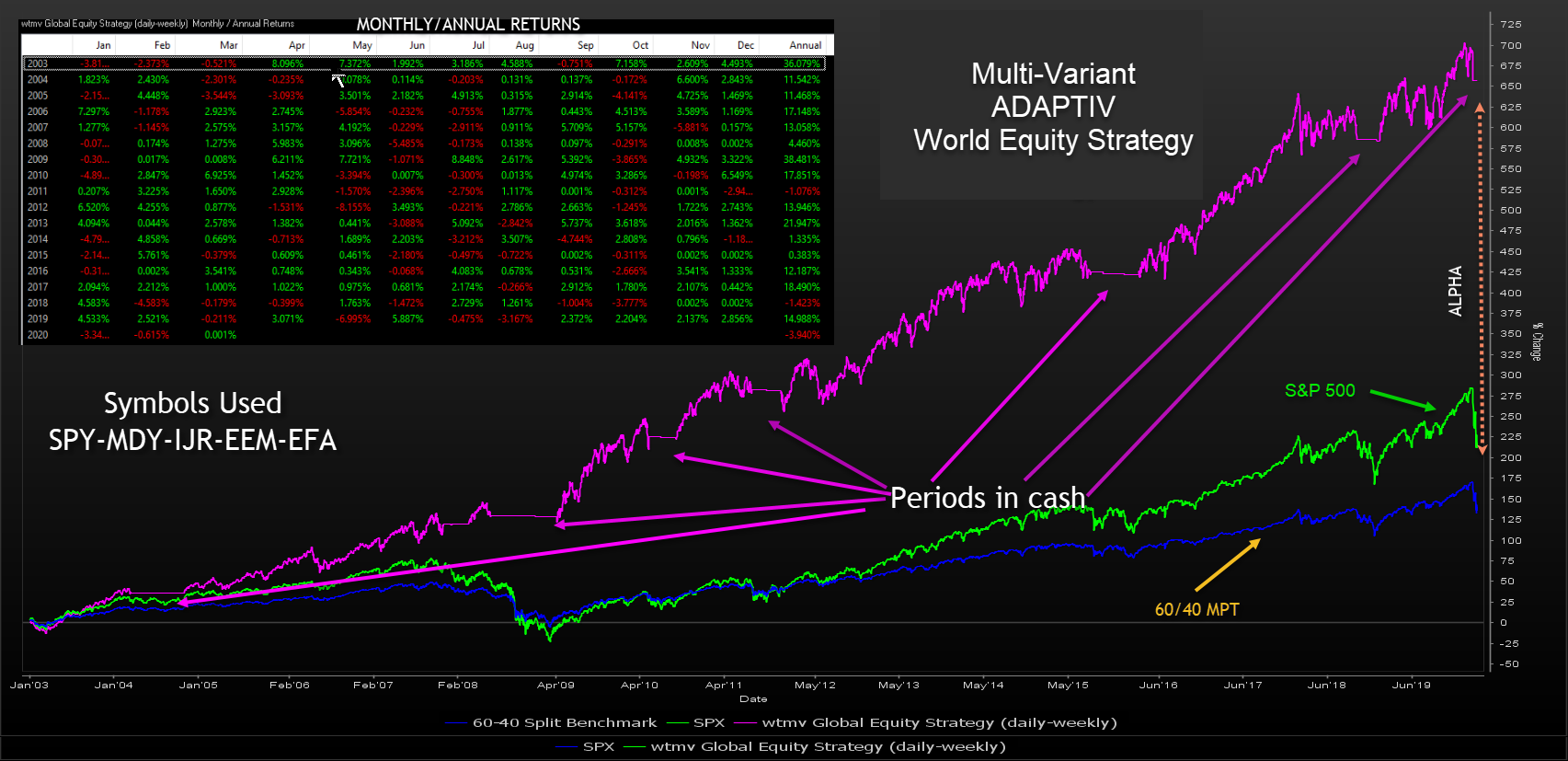

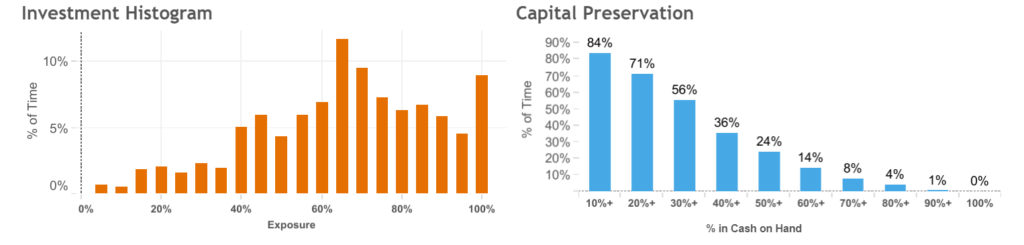

The dynamic hypothesis strategy will adjust relative risk rating a higher beta while also creating Alpha and positive cycles.Significant and persistent source of return without the use of leverage.

TIME-TESTED ALGORITHMS

Measuring Probabilities of Outcome & Risk

How would you like to avoid the random walk through the markets can alleviate much anxiety for the advisor as well as the client. Unfortunately, Most advisory firms are willing to take that walk utilizing passive allocation strategies telling their clients that asset volatility is just part of the game.

The portfolio expert team have also developed a series of prebuilt strategies meant to help advisory firms achieve this differentiation nation of risk/return objectives.

- Your portfolios will change your risk profile.

- Free up your decision-making.

- Cross-functionality with your process.

TOOLS OF THE TRADE

Zero cost trading

The dynamic hypothesis strategies enable your portfolios to adjust to changes in the economy and market conditions.

Many advisory firms have been subject to large swings of AUM loss of income and damaging client relationships.

IN DEPTH ANALSYSIS

Fractional Shares

Our Platform applies scientific rigor and in-depth analytics to measure and manage risk with a sharp focus on upside capture while providing downside protection

- Also create alpha in advancing market trends.

- Adjust relative risk creating a higher beta.